Excess Inventory Hurts Nike Profits: How to Deal with Supply Chain Issues

Excess Inventory Hurts Nike Profits: How to Deal with Supply Chain Issues

Supply chain issues, exacerbated by the COVID crisis, hurt retailers and consumers alike by playing havoc with inventory levels. Too little inventory, and retailers miss out on sales. Too much inventory and retailers use up their cash by holding inventory that isn’t turning fast enough.

These issues hit athletic-wear manufacturer Nike hard in its late 2022 and early 2023 fiscal quarters, with excess inventory dramatically impacting profits. How can Nike and other companies better deal with these supply chain-driven inventory issues? It’s a challenge for all involved.

Key Takeaways

- Ongoing supply chain issues and shifting consumer demand are resulting in bloated inventory levels

- Nike reported a record 44% increase in Q1 inventory due to supply chain issues

- Unreliable supply chains make JIT inventory increasingly untenable

- The solution requires AI and ML technology to better predict both buying patterns and supply sourcing

How Supply Chain Issues Play Havoc with Inventory Levels

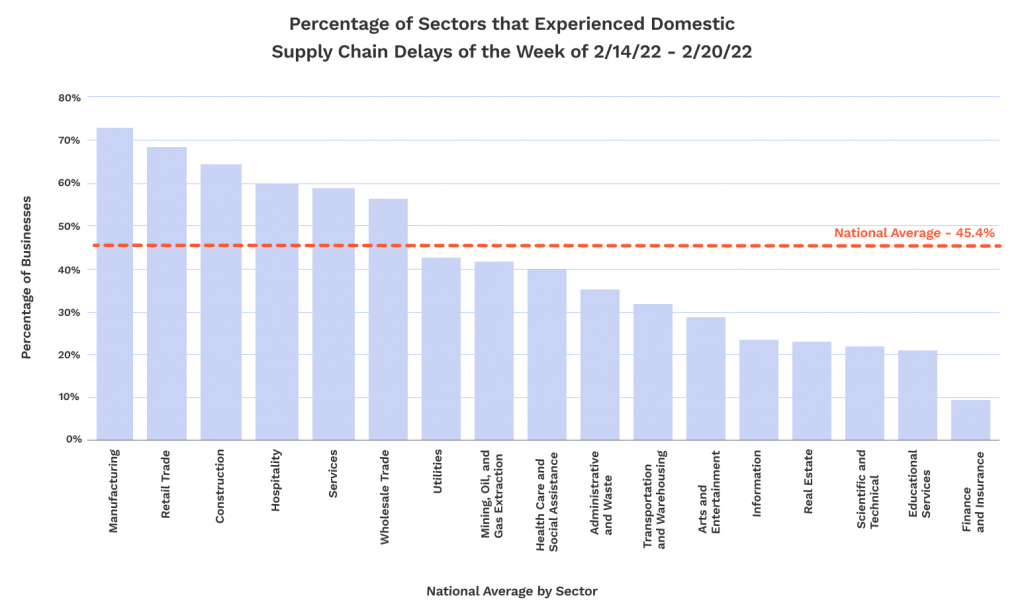

The COVID crisis dramatically affected global supply chains. Early shortages due to shuttered factories and fragmented transportation systems gave way to bloated inventories as production caught up with and surpassed the delayed demand. Retailers today are more likely to suffer from excess inventory than product shortages.

What Is Causing the Inventory Crisis?

What’s behind today’s ballooning inventory levels? There are several factors:

- Products from Asian factories were held up due to shipping delays and port congestion, resulting in retailers receiving inventory after the normal selling season was over

- Because of uncertainties due to supply chain issues, some retailers increased their orders to make sure they had sufficient stock. When deliveries normalized, retailers found themselves with too much inventory

- Post-COVID, with rising inflation and recession fears taking hold, consumers changed their buying habits. They bought fewer expensive branded products and more value-priced items, leaving retailers with too much of the wrong inventory

In short, supply chain delays in 2021 into early 2022, combined with shifts in consumer buying patterns, are causing excess inventory build-ups later in the year. Some of these issues were unpredictable, while others could have been anticipated.

How Are Retailers Coping with Excess Inventory?

The resulting excess inventory is causing many issues for retailers across the country. Not only are inventory levels growing to unacceptable levels, but retailers are also running out of space to hold all that inventory. Some companies rent temporary warehouse space or use trailers to store excess goods in parking lots.

The inventory issue also forces retailers to slash prices on now slow-moving goods, even as consumer buying patterns shift towards the holiday season. Customers benefit from heavy discounting as retailers try anything to move the products they no longer want—including shifting slow-moving items to off-brand retailers and dollar stores.

Retailers also want to adapt their supply chains to ward off future issues. According to RetailNext, 56% of companies renegotiated supplier contracts, and 28% investigated alternative sourcing options.

Supply Chain Issues Strike Nike

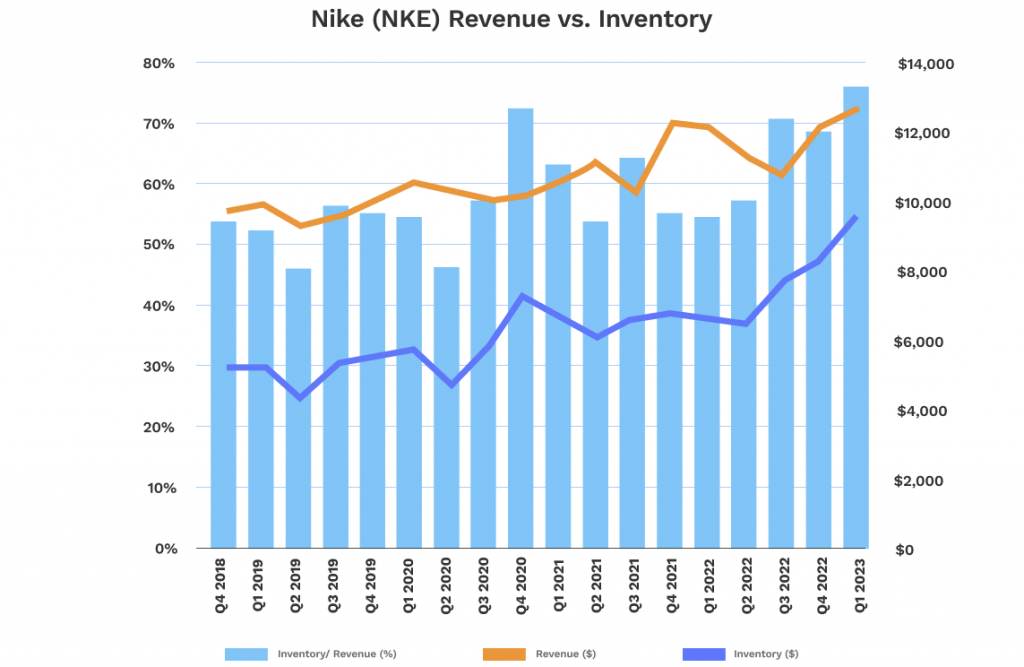

One noticeable victim of these supply chain issues is Nike. The manufacturer of Converse, Jordan, and Nike brands reported a 44% increase in quarterly inventory in the first fiscal quarter of 2023 to a staggering $9.7 billion—the company’s highest inventory level in history. The company warned of a squeeze on profit margins and experienced a 14% drop in share price.

The company said COVID-related supply chain issues resulted in late deliveries and an unexpected inventory build-up of seasonal products. These problems left the company with several different seasons worth of goods in stock at the same time—including a wealth of out-of-season goods.

Nike is not passively accepting the situation. Matthew Friend, Nike’s CFRO, says the company is taking steps to “take that inventory and more aggressively liquidate it so that we can put the newest and best inventory in front of the consumer in the right locations.”

How to Deal with Supply Chain Inventory Issues

The key to avoiding excess or insufficient inventory is improved forecasting. Companies have to forecast consumer demand and shipments from their suppliers—which is more difficult when supply chains are in flux.

One problem with demand forecasting is that it traditionally comes from past buying patterns. When external factors uproot consumer demand, such as inflation and COVID quarantining, past trends become less predictive.

Forecasting supplier capacity is also problematic during times of supply chain disruption. Prior manufacturing and shipping patterns are unreliable. Workers can’t get to the factory, and shipments get delayed in transit.

On the one hand, this argues for a move away from just-in-time (JIT) inventory. Given supply chain variability, companies can no longer depend on speedy replenishment from their suppliers.

On the other hand, if JIT shipments are no longer feasible, it’s tempting to increase inventory levels to compensate. As is evident from the inventory bloat at Nike and other companies, this isn’t a good approach, either.

The solution to today’s inventory issues requires technology. Consumer demand and inventory management systems incorporating artificial intelligence (AI) and machine learning (ML) help to thoroughly analyze buying patterns in the light of real-time external trends, thus improving the precision of sales projections. AI and ML also enable faster decision-making, essential in an era where external factors can disrupt systems in the blink of an eye.

Extreme supply and demand variability will likely be with us for some time. Easy demand predictability and a stable supply chain are things of the past. The changing economic environment requires reinvention across all business systems, including logistics. Companies want to avoid stock-out situations and too much of the wrong kind of inventory. They must develop robust inventory intelligence, real-time analytical systems, and actionable contingency plans. It’s not just a matter of finding alternative manufacturing sources. It’s a complete rethinking of the supply chain and how to manage inventory.

Turn to Hypersonix for Superior Retail Intelligence

Hypersonix is a leading provider of retail intelligence and profit optimization software. Our AI-based solutions improve demand forecasting, inventory management, and other key business functions. We utilize 11 separated AI engines to provide both predictive and prescriptive analysis, so you can react quickly and do what needs to be done to maximize your revenues and profits.

Contact us today for a free demo!

.png)