What Private Labels Are Really Doing to Your Shelf Strategy

What Private Labels Are Really Doing to Your Shelf Strategy

In today’s hyper-competitive retail landscape, shelves are more than just a place to stock products. They are a battleground for consumer attention, a reflection of brand identity, and one of the most direct levers for profitability. Among the most significant disruptors reshaping shelf strategy are private labels. Once considered second-tier alternatives, private-label products have evolved into sophisticated, competitively priced offerings that often rival or even surpass national brands in consumer perception.

For national brands and retailers alike, this shift is creating new challenges and opportunities. Understanding what private labels are really doing to your shelf strategy is critical, and managing the balance requires both precise insights and advanced tools like those delivered by Hypersonix.

To see how deep this transformation goes, we first need to understand how private labels have evolved and why they are no longer just the cheaper option on the shelf.

The Rise of Private Labels on the Shelf

Private labels have moved far beyond generic “value” products. Today, they are crafted with intentional branding, innovation in packaging, and sharp pricing designed to capture price-sensitive yet quality-conscious shoppers. As retailers increase their private-label investments, they often allocate more shelf space to them, directly impacting national brand visibility.

This isn’t only about placement. It’s about perception. When customers see private labels sitting next to higher-priced national brands, the contrast can shift consumer behavior. Shoppers may gravitate to the lower price point, especially in categories where the quality gap is perceived to be minimal. In essence, private labels are redefining how consumers evaluate value right at the shelf.

This rise in quality and consumer acceptance brings with it new pressures for both national brands and retailers, reshaping the fundamentals of shelf strategy.

Shelf Strategy Under Pressure

For national brands, private labels intensify competition not only on price but also on positioning. A strong private-label assortment can:

- Reduce the visibility of national brands by occupying premium or eye-level shelf placements.

- Anchor category pricing lower, making branded products appear expensive even if their pricing is aligned with historical norms.

- Reshape customer loyalty, as consistent private-label experiences reinforce the perception of value and encourage repeat purchases.

For retailers, this shift presents a different kind of challenge: how to balance private-label expansion with the need to maintain profitable relationships with national brands. Too much emphasis on private labels may alienate key suppliers; too little, and retailers miss opportunities for higher margins and differentiation.

While placement and perception matter, it is pricing that ultimately sets the tone for how private labels influence categories and challenge national brands.

Pricing: The Critical Lever

Private labels exert their greatest influence through pricing. They are typically positioned to be anywhere from 10% to 30% cheaper than their national brand equivalents. This deliberate gap creates a psychological anchor that can make national brand prices feel inflated.

But getting the pricing balance wrong can backfire. If the gap is too wide, retailers risk training customers to always choose private labels. If it is too narrow, private labels lose their edge as the value alternative. Managing this delicate balance requires ongoing analysis of competitor moves, elasticity modeling, and predictive insights — all areas where Hypersonix provides a distinct advantage.

Striking the right pricing balance is far from simple, and this is exactly where advanced AI solutions come into play.

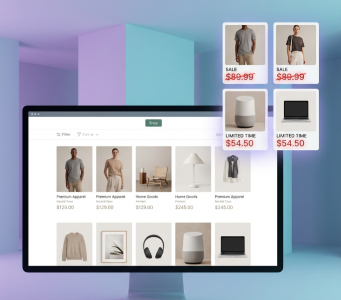

How Hypersonix Helps Retailers Balance the Shelf

Hypersonix delivers the intelligence retailers need to make informed, profitable decisions about how private labels and national brands coexist on the shelf.

-

AI-Powered Product Matching

Private-label products rarely have direct SKU equivalence with national brands, making comparisons difficult. Hypersonix’s advanced product matching algorithms — leveraging computer vision, large language models, and contextual attribute analysis — link private labels with their branded counterparts, even when packaging, naming, or UPC codes differ. This allows retailers to understand the true competitive set in each category and avoid blind spots. -

Daily Competitive Tracking

With Competitor AI, retailers can monitor how competitors are pricing their private labels versus national brands. This daily intelligence ensures they are not undercut or left behind in categories where margins are most sensitive. -

Pricing AI for Margin Precision

Pricing AI goes beyond competitive data by modeling elasticity, clustering key value items, and projecting demand. This ensures that both private-label and national-brand pricing strategies work together to protect category profitability while maintaining shopper trust. -

Promo AI for Smarter Promotions

Private labels often feature heavily in promotions, from bundles to BOGO offers. Promo AI helps retailers evaluate which promotions drive true incremental lift and which cannibalize branded sales without adding margin. The result is smarter promotional balance across the shelf.

The impact of these capabilities becomes clear when applied to real-world retail environments.

Case in Point: Shelf Strategy in Action

Consider a supermarket chain that leaned heavily into private-label expansion. By using Competitor AI and Pricing AI together, the retailer identified the optimal price gap between its private-label line and national brand competitors. The tools revealed that in some categories, narrowing the gap slightly increased overall category revenue by preventing national brand erosion while still attracting price-sensitive shoppers.

The result: higher private-label share, preserved national brand strength, and improved margins across the board. This example underscores the importance of balancing both sides of the shelf, rather than favoring one at the expense of the other.

These results highlight a larger lesson: private labels are not a threat to be managed but a force to be integrated into a smarter, more balanced shelf strategy.

Rethinking Shelf Strategy in the Private-Label Era

Private labels are no longer passive fillers of shelf space. They are active competitors reshaping shopper perceptions, altering category price structures, and forcing both retailers and national brands to rethink their strategies. For retailers, the key is not choosing between private labels and national brands, but orchestrating both in harmony to maximize profit and customer loyalty.

Hypersonix provides the tools to make this possible. By combining daily competitive tracking, advanced product matching, and AI-driven pricing recommendations, retailers gain a clear view of how private labels are influencing the shelf and how to strike the right balance.

Ultimately, the success of any shelf strategy lies in how effectively retailers turn these insights into sustainable profit and long-term customer loyalty.

Conclusion

What private labels are really doing to your shelf strategy is more profound than just competing on price. They are altering consumer expectations, redefining category benchmarks, and forcing a reevaluation of how shelf space is allocated and priced. Retailers that treat this shift as an opportunity, supported by AI-driven insights, can turn private-label growth into a powerful lever for profitability.

With Hypersonix, shelf strategy becomes less about reaction and more about precision ensuring every inch of the shelf is working to protect margins, build loyalty, and drive sustainable growth.

Related Resources:

How Retailers Can Move From Competitive Parity to Competitive Foresight

How Retailers Can Move From Competitive Parity to Competitive Foresight

How Pricing Software for eCommerce Helps Brands Win Without Racing to the Bottom (Strategic Restraint Enabled by AI Insight)

How Pricing Software for eCommerce Helps Brands Win Without Racing to the Bottom (Strategic Restraint Enabled by AI Insight)

Pricing Software for eCommerce: Turning Small Price Changes into Scalable Profit Gains (Micro-optimization powered by Pricing AI)

Pricing Software for eCommerce: Turning Small Price Changes into Scalable Profit Gains (Micro-optimization powered by Pricing AI)