DTC brands see share prices plummet. How can they do to restore value?

DTC brands see share prices plummet. How can they do to restore value?

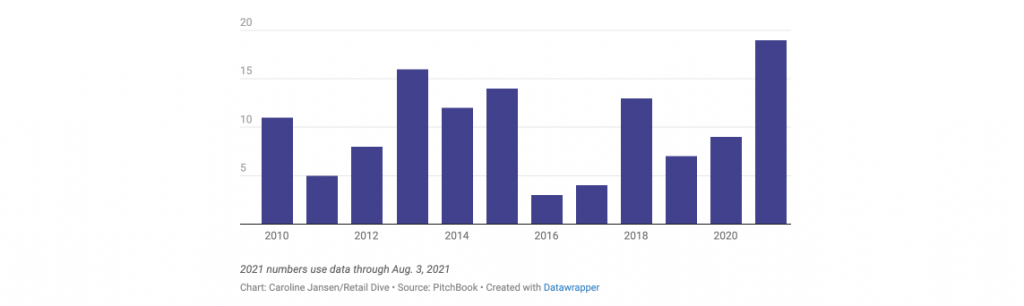

In 2021, many direct-to-consumer (DTC) brands — including Allbirds, Warby Parker, and FIGS — went public. In fact, IPOs among these types of companies were up more than 100% from the previous year.

Despite this positive trend, investors that gobbled up shares in the immediate aftermath of each company’s IPO no doubt regret their decisions right now. Though the entire stock market has been tepid for much of 2022, DTC brands have been especially impacted. Warby Parker, for example, has seen its share price drop nearly 80 percent since November 2021.

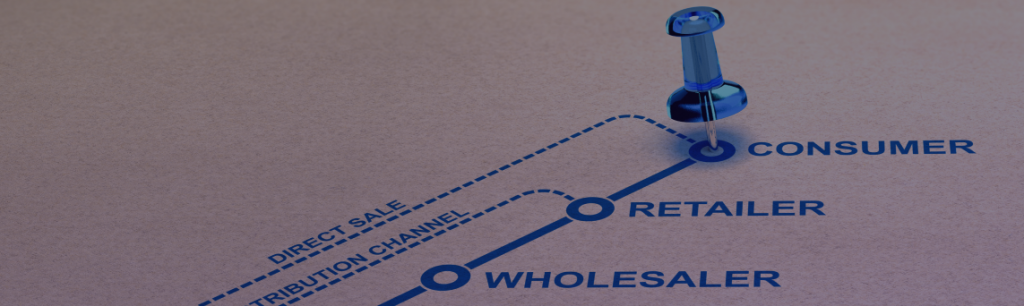

Shareholders were initially enticed to invest in DTC brands due to their agile operations. Unlike brick-and-mortar retailers, DTC brands don’t rely on a massive physical footprint. They also don’t count on retailers to sell products on their behalf. Instead, they directly engage with customers on the internet, enabling them to easily sell to consumers across the country — and even around the world.

Despite these benefits, DTC brands find themselves struggling mightily today. According to one recent report, this is due to a confluence of factors — including increasing shipping costs, a recession-bound economy that’s forcing consumers to reconsider their spending habits, and increased online advertising expenses.

While DTC brands are no doubt facing a perfect storm, all hope is not lost. In order to save their proverbially sinking ships, these companies should focus on one thing and one thing alone: profit optimization.

Maximizing shareholder value with profit optimization

With sluggish sales impacting the bottom line, DTC brands need to maximize their margins on each and every transaction if they want to reverse their Wall Street trends. And the easiest way to do that is by using a purpose-built, AI-powered profit optimization engine that automatically leverages ecommerce data to determine the best possible prices for each product line at any given point in time.

Without the right tools in place, profit optimization is a herculean undertaking that DTC companies will struggle to master in the best case scenario. By investing in profit optimization technology, figuring out the best prices becomes a breeze — which, in turn, helps DTC brands wring the most value out of every single sale.

With profit optimization guiding the way forward, DTC companies may be able to increase their revenue even when the total number of transactions declines — delighting their most loyal shareholders along the way.

To learn more about how a profit optimization engine can transform your ecommerce sales and help you weather the approaching economic storm, request a demo of Hypersonix today.