How AI and ML Drive Ecommerce Profitability

How AI and ML Drive Ecommerce Profitability

Even as the threat of a recession hangs over the U.S. economy, the artificial intelligence (AI) and machine learning (ML) niche in the tech industry continues to attract more venture capital than startups can spend. Unless you’ve been entirely offline the past few months, you have likely come across numerous stories about AI and ML on your newsfeed and timelines.

While the current buzz largely focuses on the potential effects of AI on white-collar jobs like programming and copywriting, recent developments in AI and ML to optimize ecommerce profitability have provided retailers with powerful tools for maximizing profits and streamlining inventories.

Attracting over 100 million users in under two months, OpenAI’s generative chatbot ChatGPT has dominated headlines and become the most rapidly adopted consumer app in history. With the world’s major tech players like Google, Microsoft, and Salesforce investing nine-figure sums in AI projects, AI and ML tech have captured the public’s attention and investor confidence around the globe.

The global AI and ML tech market has doubled in size in the past two years. Current growth projections estimate it will sustain a compound annual growth rate of 38% through 2030, expanding nearly tenfold from a value of $164.99 billion in 2023 to $1.59 trillion by 2030.

The growth of AI tech will leave few business models unchanged. Looking forward, businesses in all sectors must consider the impact of AI on their industries and how to leverage it for success in a rapidly evolving commercial environment.

In this guide, you’ll learn what AI and ML are and how they can drive profitability and streamline operations for ecommerce companies.

Key Takeaways

- Artificial intelligence (AI) and machine learning (ML) technologies have attracted vast amounts of venture capital and are poised to transform ecommerce and global business.

- AI is a field of computer science that empowers programs with adaptive problem-solving capabilities.

- ML algorithms consume data to generate AI’s adaptive qualities.

- AI and ML can monitor and process diverse sources of internal and external data to give ecommerce businesses automated, actionable insights that drive profitability and elevate business intelligence.

- Case studies from AI-developer Hypersonix demonstrate how AI platforms can consistently improve ecommerce profitability by 15+%.

What Are Artificial Intelligence and Machine Learning?

When new technology concepts like AI and ML spark public interest, commentators, writers, and other non-specialists often throw technical terms around loosely, leaving definitions to their audience’s imaginations.

For most people today, AI is not a fundamentally new concept – rather, one they first encountered in science fiction. Since the popularization of concepts like the Turing test in the 1950s, science fiction writers have been fascinated with the idea of robotic or mechanical intelligence that can think and act like human beings.

While popular science fiction characters like the droids of Star Wars and Star Trek’s Data represented what AI technology might look like in the distant future, advancements in the last decade have brought many AI capabilities out of the realm of fiction and into real-world applications. However, the reality of AI often differs significantly from expectations shaped by science fiction.

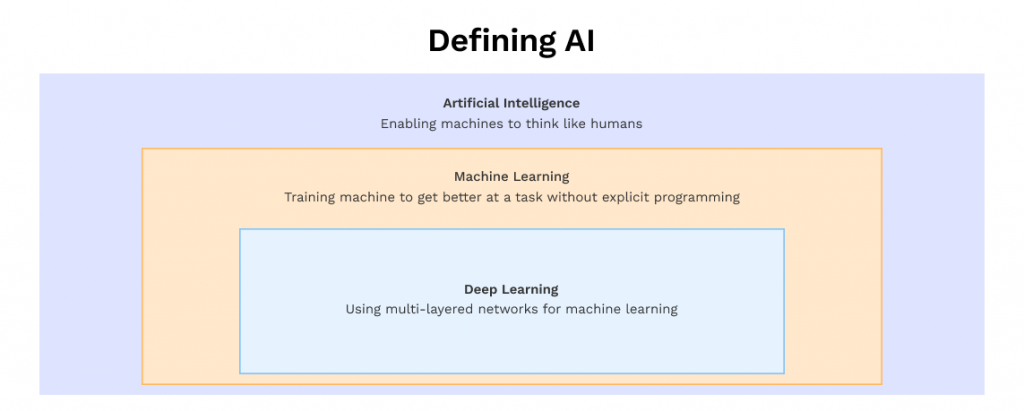

Defining AI

The hallmarks of AI are the ability to adapt – to generate new and better outputs based on the quantity and quality of inputs – and the ability to make predictions based on past behavior.

AI is a field of computer science that focuses on creating programs with problem-solving abilities. This field comprises several subfields, such as ML and deep learning. In all its forms, the hallmarks of AI are the ability to adapt – to generate new and better outputs based on the quantity and quality of inputs – and the ability to make predictions based on how the AI has observed it behave in the past.

Developers and computer scientists divide AI into two conceptual types:

- Weak or narrow: This type of AI performs specific tasks. Despite the name “weak,” today’s most impressive and popular AI applications, such as ChatGPT, Alexa, and self-driving vehicles, are examples of narrow AIs with highly developed specific capabilities.

- Strong or general: General AI remains an almost entirely hypothetical technology that would exhibit human-like behaviors without any prompt and have the ability to learn and adapt without training. While newly released chatbots can simulate human-like conversations, they still require training on specific input types and cannot develop new capabilities independently.

Machine Learning

This is a subfield of AI responsible for creating adaptive abilities. ML programs consist of algorithms that record inputs or training data and apply statistical inferences from that data to solve computational problems. As the algorithms fail or succeed at tasks, they identify patterns that lead to success and adjust their inferences for new problems.

Over time, the consumption of new data allows ML programs to refine their problem-solving strategies without hard-coded instructions for new scenarios.

What Can AI and ML Offer Ecommerce Companies?

AI and ML-enabled platforms can now guide many important executive-level decisions and strategic planning tasks with data-backed actionable insights.

Recent developments in AI and ML have broad implications for retail solutions and decision-maker processes. AI and ML-enabled platforms can now guide many important executive-level decisions and strategic planning tasks with data-backed actionable insights. These include:

- Risk analysis

- Price point analysis

- Retail supply chain monitoring and optimization

- Dynamic pricing implementation

- Inventory optimization

In a fully featured platform, these AI-enabled capabilities can deliver consistent growth of 12-17% for ecommerce companies. Many ecommerce companies remain in the early stages of complete digital transformation and still rely on manual spreadsheet analysis for business intelligence and customer insights.

To help decision-makers understand the potential of AI to enhance ecommerce sales and increase revenue, let’s look under the hood at the various component systems that work together to enable AI’s predictive abilities in retail applications.

To generate ecommerce and retail recommendations, AIs monitor a wide range of data sources that feed into 11 different kinds of ML engines to produce predictions with quantified probabilities. The monitored data sources include:

- Transactions for customers and in-house purchases

- Inventory status across stores and warehouses

- Customer actions on digital platforms, such as viewed products, downloaded assets, and created accounts

- Inputs from customer data platform (CDP) and customer relationship management (CRM) systems

- Product data

- Clickstream data

- Google Tag Manager (GTM) data

- Cost of goods sold (COGS)

- Custom variables

- Competition data

Data from these sources flows into different ML engines for analysis to target specific predictive functions.

1. Demand Forecasting

This tracks historical customer demand data and applies predictive analytics to quantify probabilities of future demand.

2. Behavioral Demand Forecasting

Behavioral demand forecasting monitors customer intent signals on a business’ website, marketing content, and social media channels. Customer intent signals include viewing product pages, filling out lead forms, signing up for demos and trials, attending webinars, and downloading gated assets.

3. Business Rules

These are guidelines a business applies to its actions and procedures to ensure compliance with policies, regulations, and strategies. Business rules typically fall into four categories:

- Definitions of business terms: Definitions vary among different organizations, and businesses may periodically amend them.

- Enumeration of business-relevant facts: Facts differ from definitions in that they represent statements that do not vary in meaning from business to business.

- Constraints or action assertions: Constraints prevent users from taking proscribed actions such as extending credit above predefined limits or adjusting customer-specific pricing beyond set thresholds.

- Derivations: These extend the application of other explicit business rules to implicit applications.

4. Product Sell-Through Velocity

Product velocity is a metric that measures the ratio of units sold to points of distribution and is useful for product demand forecasting. The formula for product velocity is velocity = sales/distribution.

However, businesses can configure sell-through velocity monitoring tools to monitor a range of averages and variable momentum. For example, a system that averages monthly data will indicate fixed weekly demand volumes. A more fine-tuned configuration will track changes in momentum, identifying periodic surges or slumps in sales.

5. Supply Chain Forecasting

Monitoring the availability and timeliness of products, their components, and raw materials is essential to advanced planning for ecommerce businesses and retailers. Besides direct supplier data, supply chain forecasting takes in data from diverse sources such as:

- National export rates

- Tariffs and taxes

- Shipping rates and average times to destination

- Fuel costs

Using these data sources, ML programs can gauge the stability of supply chain conditions and identify potential vulnerabilities before real interruptions happen.

6. Competitor Pricing Data

To implement competitor pricing strategies using software tools such as pricing engines, you need a real-time stream of price. This data can be obtained from APIs that capture changes to minimum advertised prices (MAPs) on competitors’ platforms and conversion rates across a business’ owned channels.

Additionally, profit-focused competitor pricing strategies don’t just undercut competitors. They also target opportunities for profit growth by adjusting prices based on competitor pricing, listed out-of-stocks, and demand fluctuations.

7. Product Quantities on Hand and Inbound Supply Chain

Product on hand is a measure of how much of a product is physically present on the shelves of a brick-and-mortar store or in a warehouse ready for shipping. Conversely, a business’ inbound supply chain consists of the status of products ordered but not yet received.

Generally, recommended values for product on hand are inversely proportional to the condition of the inbound supply chain. When systems detect inbound supply chain vulnerabilities or disruptions, the risk justifies the cost of higher product on hand volumes. However, when the inbound supply chain is strong and stable, it becomes profitable to lower product on hand tolerances.

8. Cost of Goods Sold (COGS)

This is a critical component of a business’s historical performance data. COGS measures the total variable cost for units of sold inventory, including manufacturing, shipping, and labor costs.

As these costs may swing wildly based on external economic and political events, businesses cannot accurately measure their profitability without considering COGS fluctuations. However, tracking this data manually is cost-prohibitive for even small-to-medium-sized ecommerce businesses.

9. Price Elasticity by Product and Category

Price elasticity measures the impact of changes in a product’s price on its supply and demand. In the simplest terms, a business can calculate price elasticity for a product by dividing any measurable change in supply or demand by the percentage of price change implemented.

However, in practice, this calculation is rarely a matter of basic division. The data that enables price elasticity measurements tends to exist in disparate systems that do not communicate with each other. Even when businesses have the IT tools to integrate data from different sources, the historical data for price changes may be too small to be statistically significant.

AI platforms can extend the inferential value of limited historical data by running extended simulations for price point changes.

10. Price Elasticity by Consumer Segment

Price elasticity varies over time across different consumer segments. Tracking and simulating price elasticity across specific consumer segments allows businesses to leverage elasticity more effectively through regional price variations and targeted inbound marketing campaigns.

11. True Order Variable Costs

Not all variable costs behave the same way. Some, like skilled labor, are only available for purchase in discrete chunks. This often requires businesses to purchase more of a component part or process than they need or will recoup in sales.

Additionally, businesses cannot store excess purchased labor or time-sensitive material goods for future use, so excess outlays necessarily go to waste. These expenses represent a business’ true order variable costs, and tracking them with AI tracking is an essential part of comprehensive risk analysis.

Hypersonix Case Studies: Illustrating the Benefits of AI-Driven Solutions

Hypersonix specializes in AI and ML-based retail solutions for ecommerce businesses. The company works with a diverse range of clients from various ecommerce sectors, using variable custom or prepackaged ecommerce platforms. Hypersonix recently performed a series of case studies that clearly illustrate the benefits the company’s AI-driven ProfitGPT platform can provide to ecommerce companies.

Hypersonix’s case studies cogently illustrate the benefits of its AI-driven ProfitGPT platform for ecommerce companies.

Case Study 1: Specialty Retailer in DIY and Home Improvement Products

A DIY and home improvement products retailer approached Hypersonix for guidance with its pricing strategies. The company had previously relied on manual spreadsheet analysis and had attempted to implement competitor pricing by undercutting major competitors.

The retailer integrated Hypersonix’s ProfitGPT with their existing Shopify-based platform and released several years of historical sales and marketing data for analysis. After implementing selected recommendations from ProfitGPT, the company recorded clear bottom-line results in the following quarter:

- Profits rose by 16.52%.

- Profit to revenue ratio improved by 3.7%.

- Neither sales volume nor velocity declined.

Case Study 2: Specialty Retailer in Fitness Equipment

A fitness equipment retailer struggling with limited and time-consuming manual analyses and pricing calculations contracted with Hypersonix to optimize profits and improve its predictive analytics capabilities. The company operated a product catalog of over 10,000 unique SKUs on a custom-built Ruby on Rails platform.

After scraping the company’s databases for relevant performance data, ProfitGPT generated recommendations that subsequently:

- Raised profits by 16.8%.

- Elevated profit-to-revenue ratio by 2.6%.

- Maintained consistent profit lift impact over several months.

Case Study 3: Specialty Retail in Books, Jewelry, Arts, and Gifts

This client had an expansive catalog comprising 40,000+ SKUs on a hybrid BigCommerce and Netsuite platform and sought help from Hypersonix in accessing better data insights and replacing limited existing calculation processes with AI.

They connected Profit OS to their BigCommerce site and Netsuite’s enterprise resource planning (ERP) platform, allowing it to process marketing and sales data from both sources. The results were consistent with previous studies:

- Profits increased by 14.4%.

- Profit-to-revenue ratio came up by 1.9%.

- Forecasted profit impact for the year reached $1.4-2.3 million.

Get Actionable Profit Optimization Insights in Just Seconds with Hypersonix’s ProfitGPT

ProfitGPT integrates out-of-the-box with the ecommerce industry’s major shop platforms, ERPs, and CRMs. With access to the data you already collect and store, Profit OS will autonomously perform risk and opportunity assessment and generate pricing and inventory recommendations you can implement with just a few clicks.

To learn more, schedule a personalized demo of ProfitGPT today.