Dynamic Pricing: The Only Guide You’ll Ever Need

Dynamic Pricing: The Only Guide You’ll Ever Need

Whether they know it by the name dynamic pricing or not, most consumers are aware that many businesses employ variable pricing according to conditions of supply and demand. Users of ride-sharing apps likely understand the surge pricing dynamic pioneered by Uber that raises prices in high-demand areas to attract drivers, ensuring customers get service and drivers receive appropriate compensation for relocating from other areas.

Alternatively, consumers may have first encountered dynamic pricing in notable extreme cases, such as what happened to clients of the Texas-based variable-rate electricity provider Griddy in the aftermath of the 2020 ice storm in North Texas. When demand spiked during the winter storm that brought prolonged subzero temperatures to areas of North Texas unprepared for such conditions, Griddy’s demand-based variables ranged unchecked and ended up delivering some homeowners’ electricity bills over $10,000 for the month of February.

Extreme cases aside, dynamic pricing has become an integral part of e-commerce operations – global e-commerce giants such as Amazon reconfigure prices as often as every 10 minutes – and both consumers and business leaders should invest the time to understand how it works. In this guide, you’ll learn what dynamic pricing is, its most common forms, and how advances in AI and machine learning are expanding its role in retail and e-commerce.

Key Takeaways

- Dynamic pricing has long existed in select industries. On the heels of technological developments and the rise of e-commerce, dynamic pricing – in many different forms – is increasingly becoming a standard feature of retail operations.

- Dynamic pricing involves adjusting prices for products and services in response to monitored internal and external changes.

- With the advent of AI and machine learning technologies capable of processing enormous volumes of data, retailers and e-commerce platforms can access radically enhanced dynamic pricing capabilities.

What Is Dynamic Pricing?

Dynamic pricing – also known as real-time pricing – refers to adjusting prices for products and services according to demand and market conditions. The purpose of dynamic pricing is to enable businesses to adjust prices regularly and on the fly in response to external events. Early examples of dynamic pricing include time-sensitive inventories such as airline tickets, hotel rooms, and concert tickets. However, with the advent of AI and machine learning in an e-commerce-driven marketplace, businesses can achieve real-time analytical insights and apply dynamic pricing to various products and services.

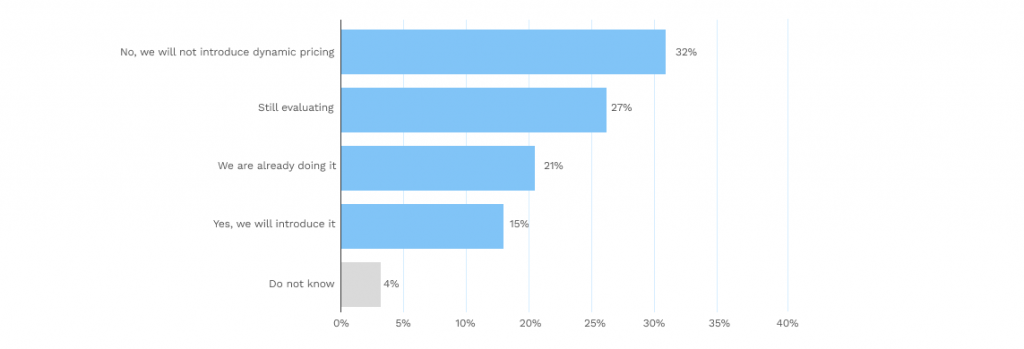

Because e-commerce platforms can effect changes immediately and do not depend on physical processes to roll out price changes in multiple locations, they benefit most from advanced analytics and AI that apply to dynamic pricing. Already, 21% of e-commerce businesses in the U.S. and Europe use dynamic pricing in their platforms and an additional 15% plan to implement it soon.

AI-driven dynamic pricing applies algorithms to large volumes of internal business data and external data sources, such as competitor pricing, market conditions, or the state of the supply chain, to adjust pricing according to predetermined rules. The rules a business adopts – and the internal and external factors they choose to monitor – depend on the goals they try to achieve through dynamic pricing. Common dynamic pricing schemes include:

1. Cost-Plus Pricing

Cost-plus pricing refers to setting product prices equal to the cost of production plus a predetermined fixed profit. In this scenario, the business monitors only internal factors, making adjustments solely based on changes in production cost. Cost-plus pricing is the most common form of dynamic pricing among U.S. companies.

2. Competitor-Based Pricing

Competitor pricing is a frequently monitored external data point in dynamic pricing. For example, in industries such as retail, small to mid-sized businesses often track and match the pricing of industry-dominant enterprises such as Amazon or Alibaba. Large enterprises change prices often, guided by their proprietary analytics. Smaller competitors who lack the internal sophistication to optimize pricing on their own then peg their prices to those that control the market.

In many platforms, competitor-based pricing is instead available to customers in real-time as an option. E-commerce sites may offer their customers the option of price matching, which assesses a database of prices for the same product or service and then undercuts the lowest by a small, fixed margin.

3. Elasticity or Value-Based Pricing

From a business point of view, the optimal price for something is the maximum customers will pay. However, this value is difficult to calculate and varies from customer to customer. Companies attempt to measure price elasticity to approximate the optimal value-based price-based price for a product.

High elasticities demonstrate high sensitivity to price changes – raise the price a small percentage, and purchasing falls off disproportionately – and low elasticities demonstrate purchase rates that remain stable through significant price changes. Inelastic products typically indicate a high level of brand loyalty and consumer identity with the product or brand.

To assess elasticities dynamically, companies can live test or apply analytic simulations to products at each price point to measure how much different customer segments value specific products, revealing a superior performing price point along the spectrum.

4. Conversion Rate Pricing

In e-commerce, businesses track conversion rates – the ratio of browsers to buyers – and frequently use price drops to offset low conversion rates. When conversion rate pricing schemes consider additional factors such as brand loyalty, time, and competitor pricing, the effect can be dramatic. For example, in a recent case study of conversion rates during Black Friday shopping, customers responded to 17.5% discounts with nearly double conversion rates.

Prescriptive and Predictive AI-Driven Price Optimization With Hypersonix

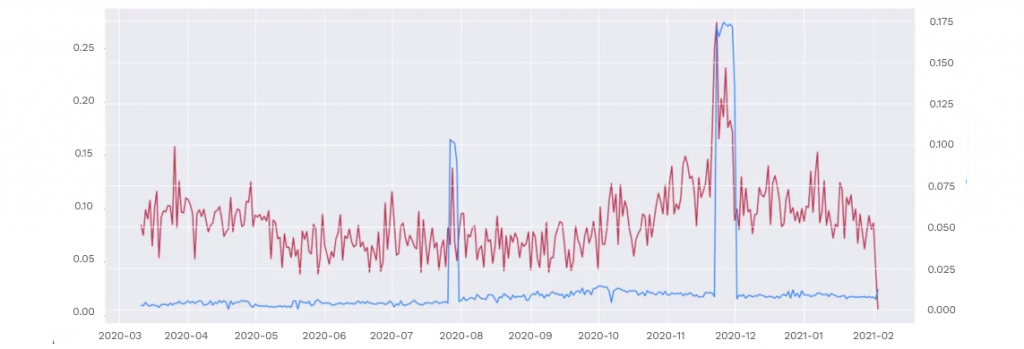

The recent pandemic and subsequent supply chain disruptions it induced have radically complicated successful pricing strategies. Businesses need the force-multiplying power of AI to translate the troves of data they capture and store into actionable dynamic pricing insights. Hypersonix’s AI platform enables real-time analysis of pricing factors across the board, such as supply restrictions, regional preferences, relevant weather data, and many others, to give decision-makers the data-driven agility to set and adjust optimal prices.

To learn more and schedule a live demo, visit Hypersonix today.

-1.png)