4 Post-COVID Consumer Trends: Retail Impact

4 Post-COVID Consumer Trends: Retail Impact

After years of waiting for a return to “business as usual,” retailers are learning that certain consumer trends are here to stay.

Retail behavior drastically shifted at the height of the COVID-19 pandemic as consumers started panic-buying toilet paper, splurging on home office equipment, and ordering delivery for every meal. While some trends have subsided over the intervening years, others appear to be here to stay.

This guide unpacks four major long-term changes in consumer behavior, their impact on your business, and strategies for success in a post-COVID world.

Key Takeaways:

- Some COVID trends have subsided, while others are here to stay. Recognizing the difference can help you adapt to uncertain times with confidence.

- While some outlets are hasty to say COVID is “over,” smart retailers realize that many consumers still care about changes to their health and safety in a post-COVID world.

- Hypersonix can help you optimize your profits in response to COVID and whatever comes next.

Short-Term Trends

Post-COVID-19, many retailers scrambled to understand the new normal. Some changes persist, but others have waned as people leave home and reenter the workforce. The following short-term trends have mostly disappeared since the height of the pandemic:

- Bulk- and panic-buying: Fearing supply chain disruptions, many consumers stockpiled non-perishable foods and hygiene items like PPE and toilet paper. This consumer behavior became a self-fulfilling prophecy as panic-buying these items in bulk created supply chain disruptions of their own. Since 2020, however, consumers have regained some faith in the supply chain, and the trend of panic- or bulk-buying is less relevant.

- Virtual events and experiences: In 2020, everybody from musicians to movie studios to karaoke bars found themselves completely shut down. In response, many organizations and individuals hosted virtual events and experiences ranging from concerts in Minecraft to virtual film festivals and museum tours. While event streaming remains popular, these online events are not as relevant for consumers who prefer in-person experiences.

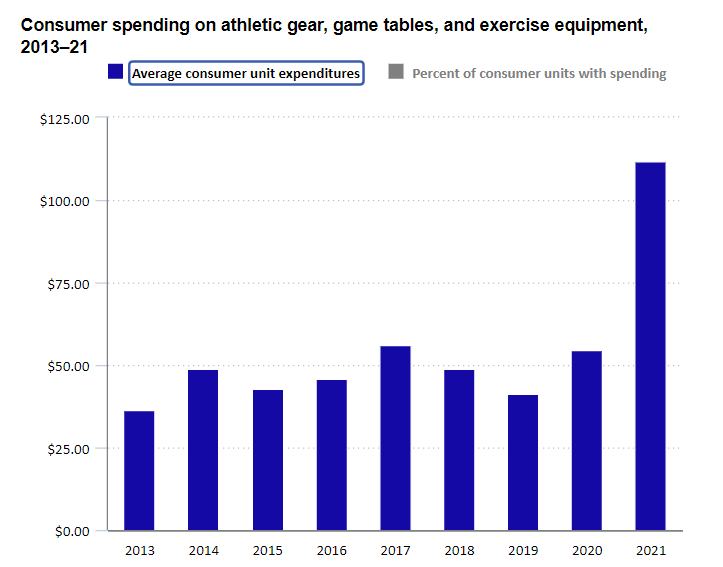

- Home office and fitness spending: The first wave of lockdowns found many consumers working, socializing, exercising, eating, and relaxing from home for the first time. This led to a sharp increase in spending on things like home office furniture, exercise equipment, and athletic gear – a trend that’s slowed significantly since 2021.

1. Self-Servicing and Contactless Payments

Before 2020, consumers viewed self-service options as either cost-saving nuisances or non-essential conveniences.

Today, they are a necessity.

Not only are some consumers still wary of the health risks of COVID-19, but many others were won over by the convenience and ease of use provided by self-service retail options. Features like self-checkout, online ordering for pickup, and digital payments are here to stay as more and more consumers adopt these technology-enabled conveniences.

While many retail consumers still prefer human cashiers and cash payments, alternative options are no longer an extra but an expectation.

2. Emphasis on Hygiene and Safety

While the wave of spending on PPE and COVID tests has largely died down since the height of the pandemic, consumers remain more mindful of their health and safety.

Post-COVID Panic

COVID-19 was catastrophic for the global workforce, especially in America, with consumers reacting in panic.

While attitudes toward social distancing and PPE have mostly relaxed, COVID-19 reinvigorated health-conscious retail trends like health foods, healthcare spending, and exercise. Today’s consumers are more cautious about their health and more willing to invest in hygiene and safety.

Long COVID

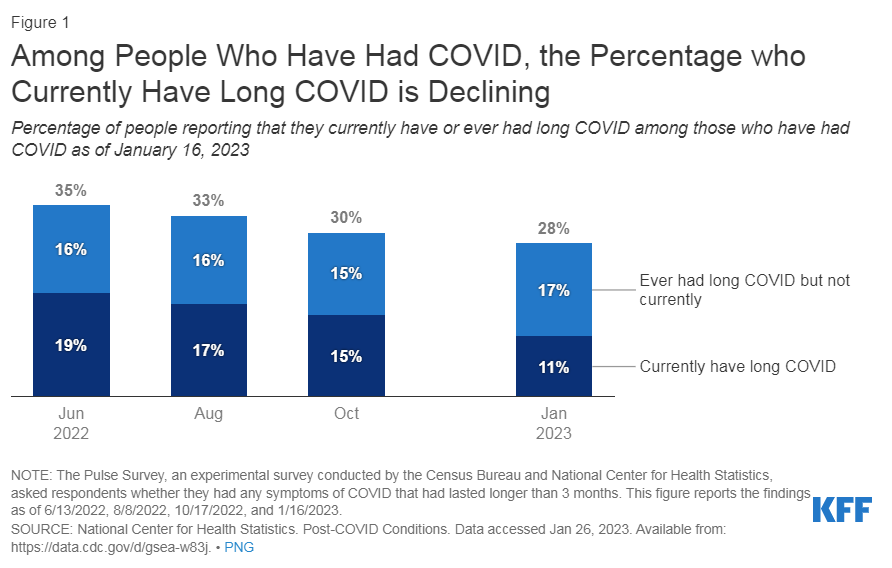

While 0.3% of the U.S. population died from COVID-19, many still experience long COVID symptoms.

Long COVID, or Post-COVID Conditions – a long-term health condition caused by COVID-19 – has left as many as four million Americans unable to work.

Over time, more and more individuals report that their long COVID symptoms have improved or disappeared altogether. While some news sources claim COVID is “over,” smart retailers realize that consumers are still living with the effects of COVID and adapt to meet those needs.

3. Increased Virtuality and Ecommerce

One of the defining features of the post-COVID retail landscape is the accelerated shift toward ecommerce. What started as a way for consumers to minimize COVID exposure has blossomed into a love story between consumers and the convenience of ecommerce.

Virtual events and experiences were a transient necessity, but virtuality and ecommerce continue to be mainstays in retail consumer behavior. This is due to lingering health concerns or simply due to the convenience of services like virtual counseling sessions, online grocery delivery, and the availability of ecommerce.

4. Boost in Support for Local and Sustainable Businesses

In the early days of COVID-19, it became obvious that larger companies could adapt much easier than their local counterparts. This drove many small businesses (as many as 1/3) to close their doors while companies like Amazon and Chewy enjoyed soaring profits.

Thankfully, many of these small business closures were temporary, but the disparity refocused many consumers toward supporting local, sustainable businesses.

Next Steps with Hypersonix

In a world where nothing is “normal,” retailers must create their own normal. That means recognizing retail trends, adjusting to consumer behavior, and optimizing their business to roll with the punches.

Hypersonix – a profit optimization platform – uses AI and machine learning to help online and physical retailers maximize their profitability. Through trend recognition, inventory management, and consumer behavior tracking, Hypersonix can help you optimize your business to thrive in a post-COVID world as well as whatever comes next.

Request a personalized demo to see how Hypersonix can optimize your profits today.

.png)